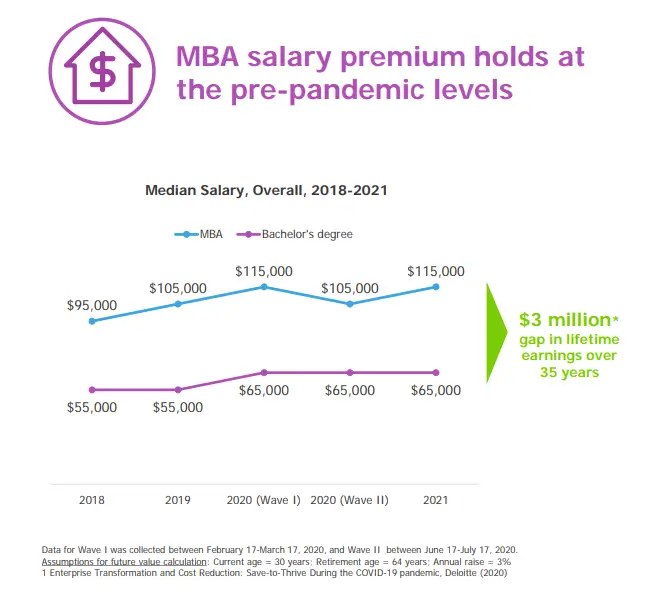

People who want to get an MBA usually do so with the idea that getting the degree will help them move up in their careers.

Many business leaders say that going to business school helped them get ahead in their careers. An MBA is often a stepping stone to leadership positions in business, and management jobs usually pay more than other jobs.

Some business schools give their students a better chance of getting well-paying jobs after they graduate. Experts say that before deciding on a program, it’s important to find out how good their career services are.

According to a survey of corporate recruiters done by the Graduate Management Admission Council in June 2021, MBA graduates who accept job offers in 2021 will get a median base salary of $115,000. This is the same amount given to 2020 graduates who were hired before the negative economic effects of the coronavirus pandemic became clear.

“Nine out of ten corporate recruiters expect the demand for business school graduates to grow or stay the same over the next five years,” GMAC said in its survey results. This shows that graduate management talent is an important part of organizations’ plans for growth.

Therefore, you will see an increase in median salaries being reported by top business schools in the coming years.

But, how have individual business schools performed when it comes to salaries? Asking this question is important since your choice for business schools could be based on the salary figures.

Let’s take a look at the average salaries of top business schools.

Average salary at top business schools

| S. No. | Business School | Average Starting Base Salary (2021) | Average Sign-On Bonus (2021) | Average Starting Base Salary (2020) | Average Sign-On Bonus (2020) | Y-O-Y Salary Change | % Salary Change | Y-O-Y Bonus Change | % Bonus Change |

| 1 | Stanford GSB | $ 161831 | $ 29148 | $ 159544 | $ 32551 | $ 2287 | 1.43% | -$ 3,403.00 | -10.45% |

| 2 | Chicago (Booth) | $ 155000 | $ 35000 | $ 150000 | $ 30000 | $ 5000 | 3.33% | $ 5,000.00 | 16.67% |

| 3 | Wharton | $ 155000 | $ 30000 | $ 150000 | NA | $ 5000 | 3.33% | NA | NA |

| 4 | Northwestern (Kellogg) | $ 150000 | $ 30000 | $ 144000 | $ 30000 | $ 6000 | 4.17% | $ 0.00 | 0.00% |

| 5 | Harvard Business School | $ 150500 | $ 30000 | $ 150000 | $ 30000 | $ 500 | 0.33% | $ 0.00 | 0.00% |

| 6 | MIT (Sloan) | $ 150000 | $ 30000 | $ 150000 | $ 30000 | $ 0 | 0.00% | $ 0.00 | 0.00% |

| 7 | Columbia | $ 150000 | $ 30000 | $ 150000 | $ 30300 | $ 0 | 0.00% | -$ 300.00 | -0.99% |

| 8 | Dartmouth (Tuck) | $ 142719 | $ 33745 | $ 143867 | $ 34171 | -$ 1148 | -0.80% | -$ 426.00 | -1.25% |

| 9 | UC-Berkeley (Haas) | $ 143696 | $ 33775 | $ 139423 | $ 31330 | $ 4273 | 3.06% | $ 2,445.00 | 7.80% |

| 10 | Yale SOM | $ 140100 | $ 30000 | $ 140000 | $ 30000 | $ 100 | 0.07% | $ 0.00 | 0.00% |

| 11 | Duke (Fuqua) | $ 141109 | $ 34958 | $ 135935 | $ 35032 | $ 5174 | 3.81% | -$ 74.00 | -0.21% |

| 12 | Michigan (Ross) | $ 144000 | $ 30000 | $ 135000 | $ 30000 | $ 9000 | 6.67% | $ 0.00 | 0.00% |

| 13 | NYU (Stern) | $ 149524 | $ 38211 | $ 143858 | $ 37892 | $ 5666 | 3.94% | $ 319.00 | 0.84% |

| 14 | Virginia (Darden) | $ 144933 | $ 35488 | $ 139945 | $ 33266 | $ 4988 | 3.56% | $ 2,222.00 | 6.68% |

| 15 | Cornell (Johnson) | $ 139121 | $ 37684 | $ 138767 | $ 36391 | $ 354 | 0.26% | $ 1,293.00 | 3.55% |

| 16 | CMU (Tepper) | $ 135000 | $ 25000 | $ 136000 | $ 30000 | -$ 1000 | -0.74% | -$ 5,000.00 | -16.67% |

| 17 | UCLA (Anderson) | $ 135273 | $ 29877 | $ 132460 | $ 31329 | $ 2813 | 2.12% | -$ 1,452.00 | -4.63% |

| 18 | USC (Marshall) | $ 130976 | $ 29473 | $ 132844 | $ 28673 | -$ 1868 | -1.41% | $ 800.00 | 2.79% |

| 19 | UNC (Kenan-Flagler) | $ 125687 | $ 29751 | $ 126957 | $ 29588 | -$ 1270 | -1.00% | $ 163.00 | 0.55% |

| 20 | Texas-Austin (McCombs) | $ 129854 | $ 28153 | $ 128586 | $ 31698 | $ 1268 | 0.99% | -$ 3,545.00 | -11.18% |

| 21 | Washington (Foster) | $ 130407 | $ 39283 | $ 125474 | $ 36380 | $ 4933 | 3.93% | $ 2,903.00 | 7.98% |

| 22 | Indiana (Kelley) | $ 120000 | $ 30000 | $ 119000 | $ 25000 | $ 1000 | 0.84% | $ 5,000.00 | 20.00% |

| 23 | Georgetown (McDonough) | $ 126107 | $ 34073 | $ 128162 | $ 34707 | -$ 2055 | -1.60% | -$ 634.00 | -1.83% |

| 24 | Rice (Jones) | $ 131384 | $ 33221 | $ 123786 | $ 33828 | $ 7598 | 6.14% | -$ 607.00 | -1.79% |

| 25 | Vanderbilt (Owen) | $ 125130 | $ 27651 | $ 126137 | $ 26991 | -$ 1007 | -0.80% | $ 660.00 | 2.45% |

Once again, Stanford has the highest reported average starting salary of any top U.S. business school, at $161,831; the next closest school reporting averages is the Stern School of Business at New York University, at slightly under $150K.

Although the University of Chicago Booth School of Business ($155K), the Wharton School at the University of Pennsylvania ($155K), Harvard Business School ($150,500), and Northwestern University’s Kellogg School of Management ($150K) all report higher median starting salaries, Stanford University’s surpasses them all.

The median starting pay at Indiana University’s Kelley School of Business was $120,000, and the starting wage at Vanderbilt University’s Owen Graduate School of Management was $125,130.

MBA Employment rates of top business schools

The number of job offers and job acceptances has gone up in 2021 as compared to 2020. 99% of the Wharton MBA class received an offer compared to 93.5% in 2020. Dartmouth Tuck and Duke Fuqua come second with 98% of the class receiving an offer in 2021.

Here are the employment rates of top US business schools.

| S. No. | Business School | Job Offers After 3 Months (2021) | Job Offers After 3 Months (2020) | Difference-Offers | Job Acceptance After 3 Months (2021) | Job Acceptances After 3 Months (2020) | Difference-Accepts |

| 1 | Wharton | 99.0% | 93.5% | 5.5 | 96.8% | 91.6% | 5.2 |

| 2 | Dartmouth (Tuck) | 98.0% | 94.0% | 4 | 97.0% | 92.0% | 5 |

| 3 | Duke (Fuqua) | 98.0% | 93.0% | 5 | 96.0% | 91.0% | 5 |

| 4 | Chicago (Booth) | 97.7% | 92.8% | 4.9 | 96.4% | 91.4% | 5 |

| 5 | Michigan (Ross) | 97.5% | 90.3% | 7.2 | 96.1% | 88.4% | 7.7 |

| 6 | Northwestern (Kellogg) | 97.1% | 95.0% | 2.1 | 96.1% | 93.0% | 3.1 |

| 7 | Virginia (Darden) | 97.0% | 93.0% | 4 | 95.0% | 91.0% | 4 |

| 8 | Cornell (Johnson) | 97.0% | 93.0% | 4 | 95.0% | 90.0% | 5 |

| 9 | Rice (Jones) | 97.0% | 90.0% | 7 | 92.0% | 89.0% | 3 |

| 10 | Vanderbilt (Owen) | 97.0% | 96.0% | 1 | 96.0% | 90.0% | 6 |

| 11 | Stanford GSB | 96.0% | 91.0% | 5 | 91.0% | 85.0% | 6 |

| 12 | Harvard Business School | 96.0% | 90.0% | 6 | 92.0% | 83.0% | 9 |

| 13 | CMU (Tepper) | 96.0% | 89.0% | 7 | 95.0% | 87.0% | 8 |

| 14 | Georgetown (McDonough) | 96.0% | 93.0% | 3 | 95.0% | 90.0% | 5 |

| 15 | MIT (Sloan) | 95.9% | 95.5% | 0.4 | 94.8% | 91.1% | 3.7 |

| 16 | NYU (Stern) | 95.8% | 92.0% | 3.8 | 95.2% | 89.0% | 6.2 |

| 17 | Yale SOM | 95.7% | 90.2% | 5.5 | 94.1% | 85.9% | 8.2 |

| 18 | Indiana (Kelley) | 95.7% | 94.8% | 0.9 | 87.6% | 85.7% | 1 |

| 19 | USC (Marshall) | 95.0% | NA | NA | 94.2% | 91.0% | 3.2 |

| 20 | Columbia | 94.0% | 90.0% | 4 | 92.0% | 87.0% | 5 |

| 21 | Texas-Austin (McCombs) | 93.8% | 88.0% | 5.8 | 92.9% | 85.6% | 7.3 |

| 22 | UCLA (Anderson) | 93.1% | 83.3% | 9.8 | 92.7% | 78.3% | 14.4 |

| 23 | UNC (Kenan-Flagler) | 93.0% | 86.0% | 7 | 91.0% | 85.0% | 6 |

| 24 | UC-Berkeley (Haas) | 89.9% | 89.1% | 0.8 | 88.3% | 86.9% | 1.4 |

| 25 | Washington (Foster) | NA | NA | NA | 97.2% | 94.2% | 3 |

Average Salary of MBA graduates by industry

Post MBA salary varies not only based on the business school, but also on what industry they choose to work in.

MBA graduates who go into consulting get the highest base salaries on average, while those who go into government tend to get the lowest base salaries.

According to data from U.S. News, a recent MBA graduate who works in the consulting industry makes on average about $60,000 more than a similar graduate who works in the government sector. These salary averages are weighted averages, which means that salary numbers from B-schools that send a lot of graduates into a certain field are given more weight than salary numbers from schools that only send a few graduates into a field.

| Industry | Average Base Salary (2021) |

| Consulting | $147,178 |

| Financial Services | $138,834 |

| Technology | $128,442 |

| Healthcare | $116,250 |

| Retail | $115,485 |

| Media/Entertainment | $114,706 |

| Energy | $111,080 |

| Consumer Packaged Goods | $109,556 |

| Real Estate | $108,831 |

| Manufacturing | $108,384 |

| Transportation | $92,316 |

| Non-Profit | $90,381 |

| Government | $87,675 |

How can you improve your earning potential?

One method to maximize the benefits of an MBA is to first consider career goals. To have more clarity on career goals you should have some high impact work experience, preferably, at least 4 years. With this work experience, you will be able to appreciate the kind of impact a business school education can have on your career.

A business school allows individuals to grow in their current careers or transition to a completely different field. An MBA can help you land not only high-profile general management positions at global corporations, but also occupations you might not think of while considering the degree, such as data analyst positions, leadership roles at technological startups, or entrepreneurship positions.

Prospective students with a strong sense of purpose can create MBA application essays that demonstrate conviction and discipline. Admissions officers want to see evidence that business school applicants are employable and have leadership potential.

MBA applicants must explicitly express why they plan to attend business school in the near future, as well as illustrate the unique viewpoint they can contribute to a class.

Talk to our experts for free to get guidance on how to make your profile business school worthy.